Startups: Your Best One-Sentence Pitch December 31, 2011

Posted by Ian Cheng in Funding.add a comment

Robin Wauters

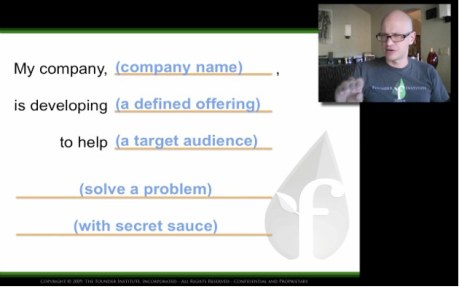

If you had to describe your company’s mission in a single sentence, what would your pitch read or sound like? One good way to summarize what you do and boil it down to one clear sentence.

This is how it’s done: “my company, _(insert name of company)_, is developing _(a defined offering)_ to help _(a defined audience)_ _(solve a problem)_ with _(secret sauce)_”.

Simple, right? In your dreams. Now, I know that the sentence above is somewhat vague but it’s spot-on, and even just thinking about this is a very useful exercise.

I’ve seen the man explain the importance of writing, refining and delivering the one-sentence pitch to a group of aspiring startup founders just a few months ago, and I thought it was great (and amusing to see even experienced entrepreneurs struggling with this). It’s way more difficult than you’d think.

The Newest VC Discrimination: If Your Startup Has A Small Team, Investment Is Harder To Get December 30, 2011

Posted by Ian Cheng in Funding.add a comment

Boonsri Dickinson, Business Insider

If you’re a small startup without a sizable engineering team, it’s going to be much harder to get venture capital backing, Deborah Gage at the Wall Street Journal reports.

If you’re a small startup without a sizable engineering team, it’s going to be much harder to get venture capital backing, Deborah Gage at the Wall Street Journal reports.

Gage notes that this has always been a problem, but unlike in the past it’s much easier to do a startup by yourself, or with a few partners.

Despite this change, VCs appear to be slow to catch up:

“You need a full complement of senior engineers,” says Sanjay Subhedar, a managing director at venture-capital firm Storm Ventures in Menlo Park. Mr. Subhedar says Storm has delayed and denied funding for companies that don’t have a strong technical leader or team. “If you need to hire eight to 10 engineers after the funding, do you know who these guys are? If you say yes, good. If you say no, it’s very difficult.”

We asked Brian Singerman, a partner at Founders Fund, for his take on the situation and he told us:

“The reason people are more insistent on a team than ever before is due to the large number of startups now. It is hard to recruit talent, so the ones that can recruit talent have a better shot. How will you be able to get employee number 20? It’s easy to get the first couple employees, they all get a decent amount of equity. It’s easy to recruit number 100 cause you obviously have a very successful company at that point. But how do you get 20 when they can go start their own iPhone app company?”

VC新歧视:小团队融资将愈发困难

如果你只是一个小创业公司,没有大的技术团队,那么融资可能将愈发困难。现在不再像过去那样自己或是与几个伙伴就能成功创业。或许正因如此,VC们的想法也在逐渐转变。

风险投资公司Storm Ventures的投资经理Sanjay Subhedar说到:“至少你需要一个完整的高级工程师团队。”如果没有强大的技术团队,Storm将会延时或拒绝向创业公司提供资金。他还说:“假如你在获得资金后需要雇佣8到10个人,你知道这些人是谁吗?如果你知道,那很棒。如果你不知道,那将很难从投资人那里获取资金。”

对此,创业者基金合伙人Brian Singerman根据自身情况如此说道:

现在的创业公司很多,投资人比以往任何时候都更重视团队。因为现在想要招聘人才很困难,所以那些能聚拢人才的团队,对投资者来说无疑是更好的选择。你怎样才能招到20名有才能的员工呢?招募最初的几个人或许很容易,因为他们可能将获得可观的股权收益。当公司做成功时,你想要招到100个员工都不成问题。但是,如果你是一个开发iPhone应用程序的公司,怎样去招20名有才能的人?

可能大家在不同的场合都有听说过VC对团队是如何重视,而一些投资人在给创业者建议时也会经常提到。团队建设状况似乎直接影响到融资的成败,而这也逐渐成为了融资“潜规则”。

Ten Steps To Attract Angel Funding December 26, 2011

Posted by Ian Cheng in Funding.1 comment so far

By Martin Zwilling

Every new startup I know dreams of being funded by an angel investor. Yet according to the latest data from AngelSoft, only about 3 out of 100 companies who initiate the formal request process actually get funded.

The AngelSoft Deal Funnel from the last 12 months indicates is that 70% of the interested companies never make it past the initial screening process. Over half of the survivors remaining are eliminated during live presentations,  and another 6.5% are eliminated during due diligence.

and another 6.5% are eliminated during due diligence.

What is this daunting process, and what can you do to optimize your chances of surviving it? Over the past 10 years, I have had the opportunity to see how the process works, several times from the startup side, and more recently from the angel perspective (as a member of an angel group Selection Committee).

So what should you do to prepare for this stage in your venture, and optimize your chances of making it through the process? Here is my list of top ten action items to best prepare you for success in achieving a funding event with angels:

1. Incorporate the business now. If you expect to require external funding, you should first incorporate as an S-Corp, C-Corp, or LLC, rather than the more expeditious sole proprietorship or partnership. The corporate entity lends itself best to the concept of “sharing” equity required by investors, and unincorporated entities don’t get funding.

2. Line up an experienced team. Remember the old adage that “investors fund people, not ideas.” That’s why this item is so important, and is probably the biggest stumbling block I see in getting through the initial angel screening. If the founders are not experienced, find a couple of advisors from the business sector to fill the gap.

3. Get your Internet domain name and website. In today’s world, if you don’t have a web site up and running, you will not be perceived as a real company. Investors routinely go to candidate web sites to get a feel for the tone and scope of the company, as well as its maturity and offerings. Reserve the company name on social networks to protect it.

4. Define some intellectual property. File a patent and trademarks to show real intellectual property. Having a defensible competitive advantage or “barrier to entry” is another critical step to funding, and another common stumbling block during all phases of the funding process. Start early on this one, or you will lose the opportunity.

5. Build a prototype product. A conundrum for many frustrated entrepreneurs is that they need money from investors to design and build a prototype product, yet most angel investors expect to see at least a prototype before they invest. Use your own money or friends and family to demonstrate progress early.

6. Build an investor presentation and summary. Investors expect a one or two-page executive summary sheet for the initial screening, backed up by a ten-slide Powerpoint investor presentation. Remember to aim the content of both of these at investors, not customers. They must amplify your “elevator pitch” to investors, as well as key points from the business plan and the financial model.

7. Prepare an investment-grade business plan. Every entrepreneur needs a professional business plan for their own use, whether they intend to seek investor funding or not. As a founder, you may think that everyone understands your vision and plan from your passion and words, but it doesn’t work that way. It should answer every question an investor or associate might ask, including current valuation, funding needed, and exit strategy.

8. Finalize your financial model. Like the business plan, a financial model is required as much for your own use as to impress angel investors. In most cases, a Microsoft Excel spreadsheet is adequate, with projection formulas for revenue, costs, and cash flow over the next five years. Variables for “what if” questions add credibility.

9. Close at least one initial customer. This must be someone who is willing to pay real money for your product or service. Free trials don’t count. All the conviction and market research in the world are no substitute for real customers paying real money. This is called “validating the business model.”

10. Network to the maximum with investor connections. The last and possibly most important action item is to build relationships with investors and friends of investors BEFORE you need their help in building your company. A good start is taking an active role in relevant technology groups, trade associations, university activities, and local business groups.

In summary, being touched by an angel can lead you to your dreams of a new and successful business, but it doesn’t happen without planning, hard work, and careful preparation. Most angel investors are seeking psychic as well as financial benefit from their investment. Do your homework first to get their attention, but don’t expect anyone to swoop down and wave a magic wand.

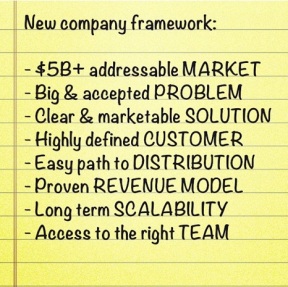

What Startup To Build? December 25, 2011

Posted by Ian Cheng in Funding.add a comment

STEVE POLAND

If you’re asking which startup to build, not whether to build, you probably have several half-baked ideas and don’t know which one to devote yourself to. Or you have no idea at all.

If you’re asking which startup to build, not whether to build, you probably have several half-baked ideas and don’t know which one to devote yourself to. Or you have no idea at all.

Max Levchin and Peter Thiel would tell you innovation is dead and that you should go work on real, world-changing, notable problems. They say too many young companies are solving small problems and creating features. TechCrunch writer Rip Empson would ask you to not build a copycat app. Paul Graham of Y Combinator would tell you to check out instead his list of 30 startup ideas he’s looking to fund.

Or programmer Chris Moyer would tell you, “If you are asking what startup to build, then maybe you are too focused on doing a startup. Find something you are so passionate about, that this isn’t a question. Then make that. Worry about the startup bit later.”

It’s easy to get trapped and excited by the startup world we read about through the looking-glass of TechCrunch. Too many entrepreneurs focus their time on building things they think are cool or could be the next startup homerun. Stop building to get covered by TechCrunch or get an investment by Fred Wilson.

What are your problems? That’s what you should be working on. Businesses are solutions to problems. Solutions come from ideas. Ideas are hypotheses. These hypotheses need to come from a defined problem. Humans have problems.

There are an infinite amount of ideas out there. I have a list of 100+ web startup ideas that you can poach from, but who knows what problems they solve. There are millions of opportunities to change and disrupt this world. However, most of those opportunities are very small and might only change the world for you or a few (which isn’t a bad thing). Instead of brainstorming ideas, start by brainstorming problems.

Problems are found in the processes that humans go through everyday. Start keeping notes of everything you do each day and things you observe others doing, at work and at home. Question the processes involved and write a few words explaining each step in the process.

Jack Dorsey of Square questioned the retail purchase process and is now making it simpler and more pleasing for consumers. Dorsey asked why there were so many steps in the process of purchasing something: Why do I have to go into my wallet, pull out a credit card, swipe a credit card, wait awkwardly while a machine checks my authorization, wait for a receipt to print, wait to be handed the receipt from the cashier, sign the receipt, hand over the receipt, be given a hard copy of my receipt, put my credit card back into my wallet, all the while having a big uninviting machine in-between myself and the cashier?

To start observing, start reading status updates by your friends on Facebook and Twitter to see what they are doing and talking about, but don’t fixate entirely on their complaints. There are many processes we all go through everyday that we accept without question, but could be simpler and more user-friendly. Just like that clunky retail purchase process that we all hadn’t questioned until a minute ago.

Help fellow entrepreneurs know your problem. Try this: add one human process you go through either at home or at work to this Quora thread: “What processes do humans experience and what steps are involved in each?” Let’s talk about what problems need to be solved so that one of you can launch a startup to solve them.

26 questions you have to answer correctly to get funding for your startup 寻求融资?请先想清楚这26个问题 December 22, 2011

Posted by Ian Cheng in Funding.1 comment so far

Goran Duskic

Goran Duškić co-founded a game development team Generation Stars when he was a teenager, and he co-founded hosting and web develpoment company GEM Studio (which was sold in 2011). He co-founded tech startup WhoAPI and has 10+ experience in business development, online marketing strategy and PR.

Goran Duškić co-founded a game development team Generation Stars when he was a teenager, and he co-founded hosting and web develpoment company GEM Studio (which was sold in 2011). He co-founded tech startup WhoAPI and has 10+ experience in business development, online marketing strategy and PR.

It’s been a crazy week. On Monday we announced that our project received funding. Member of the Croatian Angel Network – CRANE, Mihovil Barančić believes that we have what it takes to create something big and worth mentioning. But I am way ahead of myself. We’ve started to explore the possibility of getting an investment roughly a year ago. So here are some questions that we got during that time.

Why do you need an investment?

Why don’t you sell your house/company/whatever if you believe that much in your product?

Do you believe in your service?

What does your service do?

Why is that better than company x?

It’s good that your share all this info, because otherwise you’re a bozo (tm Guy Kawasaki-Steve Jobs)

What if some big company decides to copy your service?

What if your competitor or newcomer decides to copy your service and offer it half the price?

Is there any competition?

Can you see your company becoming a 10 million dollar company?

Why don’t you start localy first?

Why don’t you go global from the start? Since we were going global right from the start, we weren’t asked that question (but some probably will).

Can you bootstrap?

Can you bootstrap?

What experience do you have?

How did you get your idea?

Do you have a working prototype or a proof of concept?

Why should I invest in you instead of hiring 1/2/3 people and outsource the whole project?

Would you be willing to relocate to: capital city/London/Sillicon Valley?

If you make any kind of statement, be prepared for questions about backing up that statement with facts.

Do you have an executive summary?

Do you have a business plan?

How are you going to get your customers?

Who needs your service?

Who is you target audience?

What is your business model?

Do you have an exit strategy?

Are you prepared to give up 10%/20%/30% of equity?

How much money do you need?

Why that ammount?

I am 100% positive there were more questions, but these were the ones that first came to my mind. Good luck in finding the answers. Please, please, please help share this questions and help other startups that want to receive funding!

寻求融资?请先想清楚这26个问题

原文作者Goran Duskic是科技创业公司WhoAPI的联合创始人,本周刚获得一笔投资。Goran Duskic十几岁时就是游戏开发团队Generation Stars的联合创始人。后来又与人联合创办了GEM Studio,并在今年将其出售。他在商业发展、网络营销以及公交关系方面有超过10年的工作经验。

1. 你为什么需要融资?

2. 如果对自己的产品如此有信心,那你为什么不卖掉自己的房子、公司或其他值钱的东西筹集资金?

3. 对自己的服务有信心吗?

4. 你都哪些服务?

5. 与其他公司相比,你的优势是什么?

6. 如果一些大公司准备抄袭你的服务,你会怎么办?

7. 如果你的竞争对手或者新的模仿者准备抄袭你的服务,并且价格只有你的一半,你又怎么办?

8. 面临哪些竞争?

9. 你认为你的公司能发展到1000万美元的规模吗?

10. 为什么不先做区域市场?

11. 懂得自荐吗?

12. 你都有什么样的阅历?

13. 创意/想法是怎么来的?

14. 有展示创意/想法的原型吗?

15. 我为什么要把投资给你,而不是自己雇几个人做或是把项目外包给别人做?

16. 愿意搬去其他城市/地方吗?

17. 有没有执行纲要?

18. 有没有商业计划?

19. 如何吸引/积累用户?

20. 哪些人需要你的服务?

21. 哪些人是你的目标客户?

22. 你有怎样的商业模式?

23. 是否有应对失败的战略?

24. 你准备让出多大比例的股权?

25. 你需要多少资金?

26. 为什么需要这个数额的资金?

原作者也有说明这些绝对不是全部的问题,却是他首先想到的。

The Lean Finance Model Of Venture Capital 精益融资模型 December 8, 2011

Posted by Ian Cheng in Funding.add a comment

ERICK SCHONFELD

The venture capital industry is going through a ton of disruptions lately. One of the better explanations I’ve heard recently of what is going on comes from Duncan Davidson, a managing partner at Bullpen Capital who gave a great talk on the subject at TechCrunch Tokyo last week. I interviewed him backstage on video, where he summarized his views.

Just as there are now legions of “lean startups” which require less capital to build a product, Davidson argues that a “lean finance model” is also needed. “We are in the era of cheap. The whole concept is keep the company as lean as possible until the company validates its market, then you shovel the money in.”

Tech startups don’t need $5 million A rounds when $2 million to $3 million will do. So A rounds now get bypassed until a company proves itself and then you see these huge later-stage rounds. Or sometimes the startup gets sold for $30 million to $50 million, which is okay, since it didn’t have to grow into a huge valuation to begin with.

In this view, we are not really seeing a Series A Crunch (where the growing number of seed-funded companies are failing to find series A money). Rather, they are getting smaller amounts to see them through until acquisition or a later mega-round where the big VCs throw their weight around. “I call it a shovel-in round,” he says. “We go under the A.”

He notes that now half of all of the first institutional money going into startups is now “coming from a new breed of super angels.” This is a dramatic change from just two years ago,when less than 10 percent of the money was coming from super angels (see slide below).

The big-name VCs will still do okay. In the first half of this year, 7 top-tier firms commanded 80 percent of all the money going to venture capital. It’s the middle tier firms that are scrambling for survival.

风险投资,精益融资

最近风投界正经历一场大的变动。Duncan Davidso在采访中对这一现象给出了解释。(Duncan Davidso为Bullpen Capital的合伙人,上周在东京TechCruch做了一场精彩的演讲)

互联网新媒体行业有一批“精益初创公司”日渐崛起,他们的特点是需要相对较少的启动资金。正因为如此,在融资领域,也需要一个“精益融资模型”。 “我们正处在一个廉价的时代,这个概念的关键在于初创公司应该尽可能的保持精简 (无需大笔资金注入),直到市场认可他的产品,这时,才是大量资金涌入的时候。”

科技类的初创公司第一轮融资不需要500万美元,实际上2-3百万美元足矣。因此很多时候A轮融资被绕过,直到公司运营成功,然后大笔资金注入。也有时,初创企业以3千万到5千万美元的价格被卖。根据这种观点,目前并不存在Series A资金短缺 (Series A Crunch是指越来越多的种子期融资公司无法成功获得series A资金),只是因为资金数额减小,直到企业兼并或者大笔风投注资我们才能追踪注意到。

Duncan Davidso表示,目前一半以上的初创企业第一笔机构资金都来自“超级天使基金”。这同两年前截然不同,那时只有少于10%的资金来自这些超级天使 (见下图)

这些业界有名的风投机构表现尚佳。在今年上半年,7家顶级公司操控了80%的风投资金。真正煎熬的是中型投资公司。

Always have 18 months of cash in the bank 创业公司至少应有18个月现金 December 7, 2011

Posted by Ian Cheng in Funding.add a comment

Chris Dixon

I was once told by an experienced entrepreneur (I can’t remember who) to always have at least 18 months of cash in the bank. The logic behind this is: 1) as a rule of thumb it takes 3 months to raise money, 2) building/marketing/selling technology always takes longer than you think. Subtracting 3 months for fundraising and 3 months for things taking longer than expected, this gives you 12 months to execute your plan. (Also you never want to raise money “with your back against the wall” – when you are near the end of your runway.)

More adventurous entrepreneurs might argue 18 months is too conservative. It’s true that following the 18 month rule can be extra dilutive. At SiteAdvisor, we raised our Series A about three months before we were acquired. So we gave up equity for cash that we never spent. But in retrospect, given what we knew at the time, I think it was the right decision.

The question of when to raise money is one of the few times that entrepreneurs and early-stage investors have somewhat divergent economic interests. If you control a large investment fund, you always have the option to extend a company’s runway. The entrepreneur doesn’t have this option. I’ve even heard some entrepreneurs whisper about Machiavellian VCs who deliberately try to get you to the end of your runway so they can negotiate harder. I think this is a bit of a conspiracy theory. Almost all VCs I know care primarily about the success of their companies and not about extracting every last point of equity.

对互联网创业者来说,现金流控制是一个非常重要的问题。那么手里有多少现金才能保证公司的正常运营呢?

Hunch(已被eBay收购)联合创始人兼CEO Chris Dixon是一个连续创业者,参与创建并投资过多家创业公司,他分享了自己的看法。他认为创业公司的银行账户上至少要有18月的现金。理由是:首先融资需要3个月时间;其次开发、运营、销售产品的时间往往超出预期。除去3个月的融资时间和3个月预留时间的话,你只有12个月的时间执行你的计划。此外,谁也不想等到走投无路时才回去融资。

Chris认为创业者和早期投资者在选择融资时机时存在经济利益冲突。如果你控制着一个大型投资基金,你总有办法帮一家公司走得更远。但创业者没有这种选择。有些狡猾的VC故意把创业公司拖到路的尽头,这样他们就可以压低价格。不过还好,Dixon认为几乎他见过的所有VC都更在乎所投公司的成败,而不会在股权上斤斤计较。